Typical Price vs Median Price | Smarter Property Investment Strategies in Australia

Why Smart Property Investors in Australia Should Choose Typical Price Over Median Price

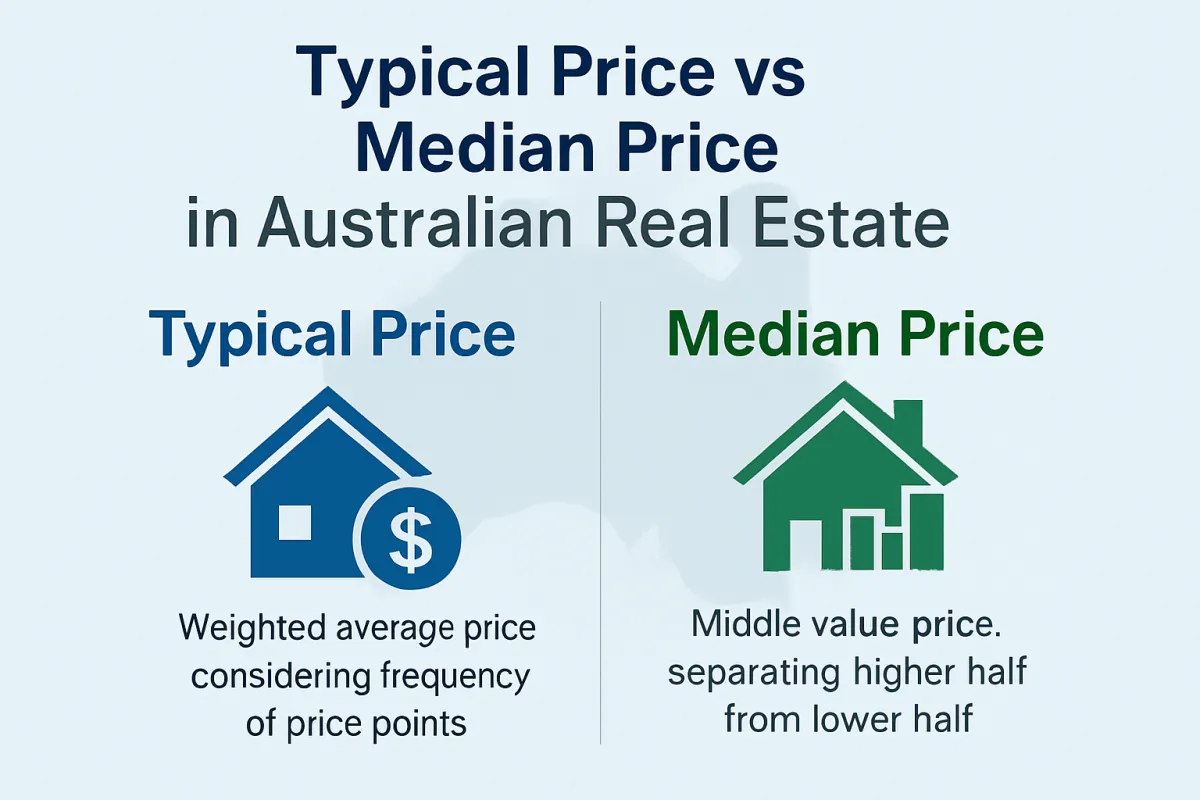

When it comes to analysing property prices in Australia, most investors rely on the Median Price. It’s everywhere, looks simple, and gives an impression of accuracy.

But here’s the catch: Median Price can be misleading — especially at the suburb level.

And if property investors base their decisions on it, they risk making costly mistakes.

That’s why at InvestFox, we use Typical Price instead of Median Price. Let’s explore why this matters for smarter property investment strategies in Australia.

The Problem With Median Price in Property Investment

On the surface, Median Price (the “middle value” of all sales in a given period) sounds like a reasonable measure. But at the suburb level, it quickly breaks down.

1. Small Sample Sizes Distort the Numbers

If only 10 homes sell in a suburb this quarter, one unusually high or low sale can shift the median by tens of thousands of dollars — creating a false impression of property market trends in Australia.

2. Property Mix Creates Misleading Data

If more large family homes sell this month and fewer units do, the median may suggest prices have risen — even though the true suburb property values haven’t changed.

3. Time Lag Hides Market Reality

Median Price usually considers the past 12 months of sales. That means today’s figure could still include data from almost a year ago, making it irrelevant for current property market insights.

👉 In short, Median Price does not always reflect what a typical property buyer in Australia would actually pay in today’s market.

Why We Use Typical Price for Market Analysis

At InvestFox, we prefer Typical Price because it’s designed to show a clearer, more accurate picture of local property markets in Australia.

Here’s what makes it different:

Stability in small markets – It smooths out random swings caused by low sales volumes.

Real-time accuracy – Updates monthly, instead of relying on outdated annual data.

True market reflection – Focuses on today’s genuine values, not distorted by rare or unusual transactions.

👉 Think of it like this: Median Price is a blurry photo, while Typical Price brings the market into sharp focus.

Why This Matters for Smart Property Investors

When you’re choosing where to buy, using the wrong number could cost you.

If you rely on Median Price – you might believe a suburb has “boomed,” when in reality, one luxury sale skewed the data.

If you rely on Typical Price – you see the real property market movement, giving you confidence, clarity, and actionable insights.

✅ With Typical Price, you’re not just looking at numbers. You’re looking at smarter investment signals that reduce risk and increase your chances of long-term growth in real estate investing in Australia.

The InvestFox Advantage

At InvestFox, we don’t stop at basic Median Price headlines.

We give our clients:

Access to Typical Price property insights

A suite of advanced property investment metrics

Data-driven clarity to make confident, smarter decisions

👉 If you’ve ever doubted whether the suburb data you see online tells the whole story, now is the time to dig deeper.

📌 Book your free property strategy session with InvestFox today and discover how Typical Price can transform the way you see the Australian property market.

FAQs: Typical Price vs Median Price in Property Investment

1. What is the difference between Typical Price and Median Price?

Median Price is the middle value of sales, while Typical Price shows a more accurate, stable reflection of what buyers actually pay in today’s market.

2. Why is Median Price unreliable at suburb level?

Small sample sizes, property mix variations, and outdated data often distort the median, making it misleading for investors.

3. How does Typical Price help property investors in Australia?

It provides real-time, stable insights, helping investors avoid costly mistakes and make smarter property decisions.

4. Is Typical Price useful for first-home buyers as well?

Yes — Typical Price provides clarity on what homes are really selling for, giving both first-home buyers and investors the confidence to act.